Section 115BAC of the Income Tax Act, 1961 has opened the horizon of opting for lower tax rates subject to the condition of non-claiming of specified exemption or deduction or additional depreciation (This is commonly referred to as the ‘new tax regime’).

Presently, the normal / old tax regime was the default tax regime under the Income Tax. It means if an assesse wants to switch to the new tax regime, then assesse has to exercise the option for the same else by default, an assesse would be falling into the old tax regime only.

However, the Finance Act, 2023 has inserted a new sub-subsection (6) in Section 115BAC to make the new tax scheme as a default scheme for the eligible assesses.

It means now the default tax regime will be the new tax regime as against old tax regime earlier and those who wants to opt for old tax regime, a specific intimation of opt out from new tax regime is required to be filed at the time of filing of Income Tax Return.

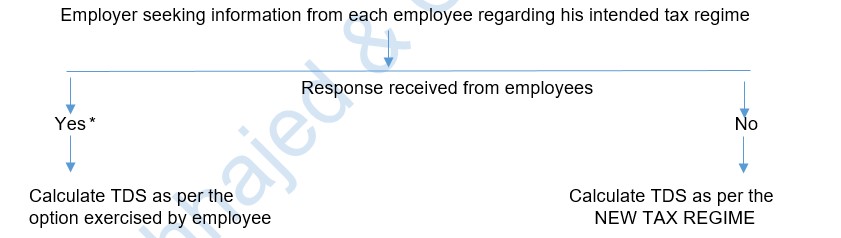

This has resulted into the concerns for the employers as they would not know if the employee would opt out from Section 115BAC i.e. new tax regime or not at the time of his / her income tax return.

Thereby, Central Board of Direct Taxes (commonly referred to as ‘CBDT or Board’) has issued the following directions for the employers which we have tried to explain in chart form.

*Option exercised herewith of opting out the new tax regime will not be treated an initiation u/s 115BA(6).

It means if an assesee wants to opt out from the new tax regime then the option to opt out has to be specifically exercised while filing the Income Tax Return which in turn will mean that irrespective of tax regime opted for TDS calculation, an employee will be at liberty to choose the option which suits him / her best at the time of filing of Income Tax Return.

Hope the above detail clarifies the doubts and you will find it worth reading.

Source: Circular No. 4 of 2023 dated 05.04.2023