???? New Income Tax Bill Introduced: Insights ???? The Hon’ble Finance Minister, Smt. Nirmala Sitharaman, announced the much-awaited Income Tax Bill, 2025, in the Union Budget 2025. This comprehensive overhaul of India’s tax structure aims to modernize, simplify, and align our taxation framework with global standards. The bill brings a fresh perspective on tax compliance […]

Section 115BAC of the Income Tax Act, 1961 has opened the horizon of opting for lower tax rates subject to the condition of non-claiming of specified exemption or deduction or additional depreciation (This is commonly referred to as the ‘new tax regime’). Presently, the normal / old tax regime was the default tax regime under[…..]

From 1st July, 2022, Section 194R will be applicable which states deduction of tax on benefit or perquisite in respect of business or profession i.e. TDS on benefit or perquisites given. It is a general practice in many industries to gift cars, luxurious trips, laptops, mobile etc. as a gift for achieving targets or as[…..]

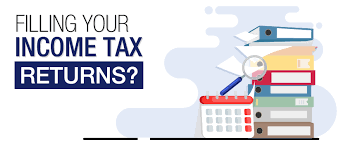

Dear Reader, Kindly find the attached image describing whether you are liable to file your Income Tax Return or not. Due to formatting issue, we could not bring text here and so attached the image file. Just zoom in to check the image.