Dear Readers, As per the decisions of the 56th GST Council Meeting, the revised rates of goods / services are being applicable from 22nd September, 2025 (except for Pan Masala, Tobacco etc.) and various notifications were issued by CBIC on 17th September, 2025 notifying the revised rates from 22nd September, 2025. The revised rates can […]

Analysis of the Decisions made at 56th GST Council Meeting dated 3rd September 2025 The detailed analysis can be accessed at; GST 2.0 – Detailed Presentation The detailed change in rates of goods and services can be accessed at; GST Rates for Goods and Services – Effective from 22nd September 2025

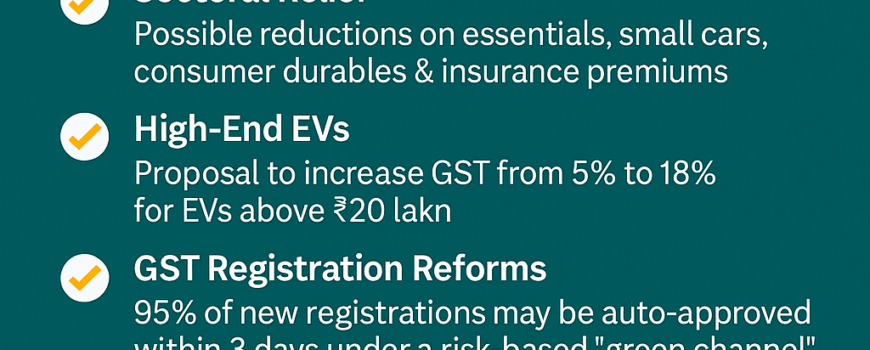

All eyes were on today’s GST Council meet – and rightly so! The long-awaited “GST 2.0” discussions have begun, and as per reputed news sources (Moneycontrol, Reuters, Economic Times, Outlook Business, TOI, CNBC), several key updates are under consideration; Key Updates (Notified Status Awaited) ✅ Two-Slab Structure Proposal Simplification to 5% & 18%, with 40%[…..]

???? New Income Tax Bill Introduced: Insights ???? The Hon’ble Finance Minister, Smt. Nirmala Sitharaman, announced the much-awaited Income Tax Bill, 2025, in the Union Budget 2025. This comprehensive overhaul of India’s tax structure aims to modernize, simplify, and align our taxation framework with global standards. The bill brings a fresh perspective on tax compliance[…..]